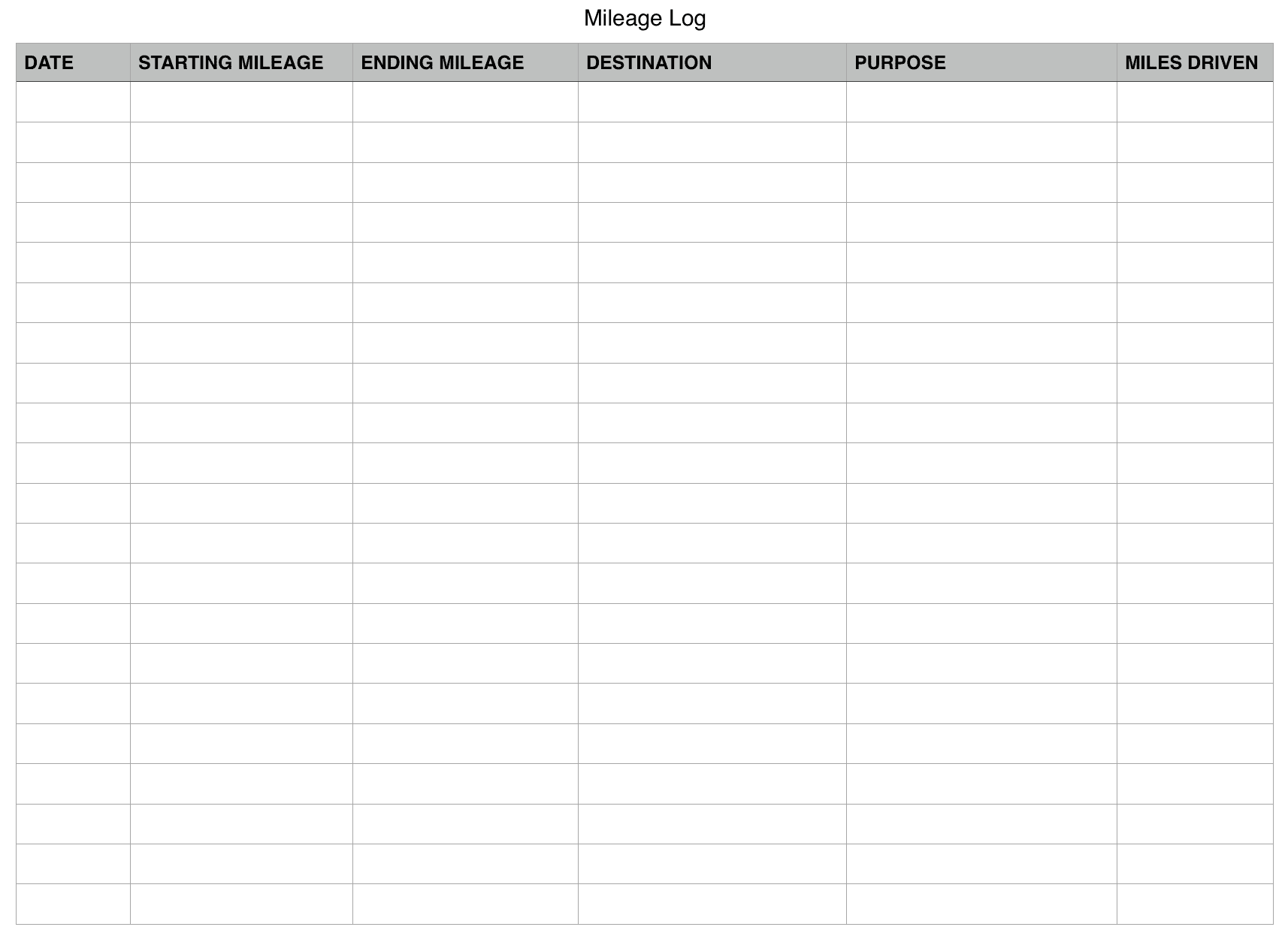

If you want to deduct mileage expenses on your taxes, you need to keep track of your mileage the right way. This means using a mileage log of some kind. The IRS states that mileage records must consist of:

- Mileage driven

- Dates of business trips

- Location driven

- Purpose

Without these four details recorded for each trip driven, the IRS is likely to throw out your claim for mileage deduction. They could even charge you fees and interest if you get audited. This is the biggest problem taxpayers face when claiming the deduction. They neglect to keep records throughout the year or the records they do keep are incomplete. Most people aren’t even aware of the strict requirements regarding mileage deductions.

You can print out a form like this and keep it in your glove box, remembering to write in the details on each trip.

Or, to make it easy, you can use an online tool to help you log your mileage. Timesheets.com is a helpful tool to track attendance along with mileage to help log your reimbursable expenses. Everything is easily accessible on a timesheet so you can create reports within seconds for payroll.

Ready to try Timesheets.com? Start a free trial today!

7 Responses

My name is Kimberly I live in Milwaukee Wisconsin and I drive to Waukesha Wisconsin to Big Bend Street every morning and every afternoon but I haven’t got travel time pay the company says the pay is in my hourly work I work for a home care provider and I was Wonder do I qualify to get paid to ride from Milwaukee Wisconsin to Waukesha everyday twice a day is it legal for them to put the traveling time into my work pay

Generally, people don’t get reimbursed or paid travel time for their commute to work.

What if a company dosnt reimburse any mileage when I travel out of state?

Can you give an example of how to log your purpose? Would IRS eg accept writing “sales meeting” without specifying with whom?

Hi Martin, I would suggest that you actually speak with a Tax expert with your question