What are the benefits of an expense management system?

Expense management systems are used to streamline a variety of tasks including expense reporting, reimbursement, and analysis.

Home > business expenses

Expense management systems are used to streamline a variety of tasks including expense reporting, reimbursement, and analysis.

Understanding how to calculate the Cost of Goods Sold (COGS) is essential for businesses. Learn what COGS is and how to calculate it.

Although millions of people have recently joined the remote workforce, many employees still travel to work daily. Some workers travel more than others, though. Many employees, such as home care providers and …

Owning and running a business is costly. In fact, most business owners are shocked when they see how much they’re spending in the office. Small costs here and there really add up …

Throughout the past few weeks the coronavirus has left the world empty and desolate. With lockdown measures and social distancing orders in place, people refrain from going to restaurants, communicating in-person, and …

Giving your employees time off is a benefit that isn’t required by the FLSA. Since time off is nonobligatory, most employers believe that they are exempt from paying out employees when they …

* As of March 21st, 2020, The Treasury Department and Internal Revenue Service extended the federal income tax filing due date from April 15, 2020, to July, 15, 2020. Taxes are difficult …

If you run a small business, you’re going to want to file your tax deductions accurately. Properly filing tax deductions will give you a larger tax return. Unfortunately some businesses are not …

The IRS allows you to choose any record keeping system for your business’ income and expenses. This means that you can keep records in a file cabinet or you can choose an …

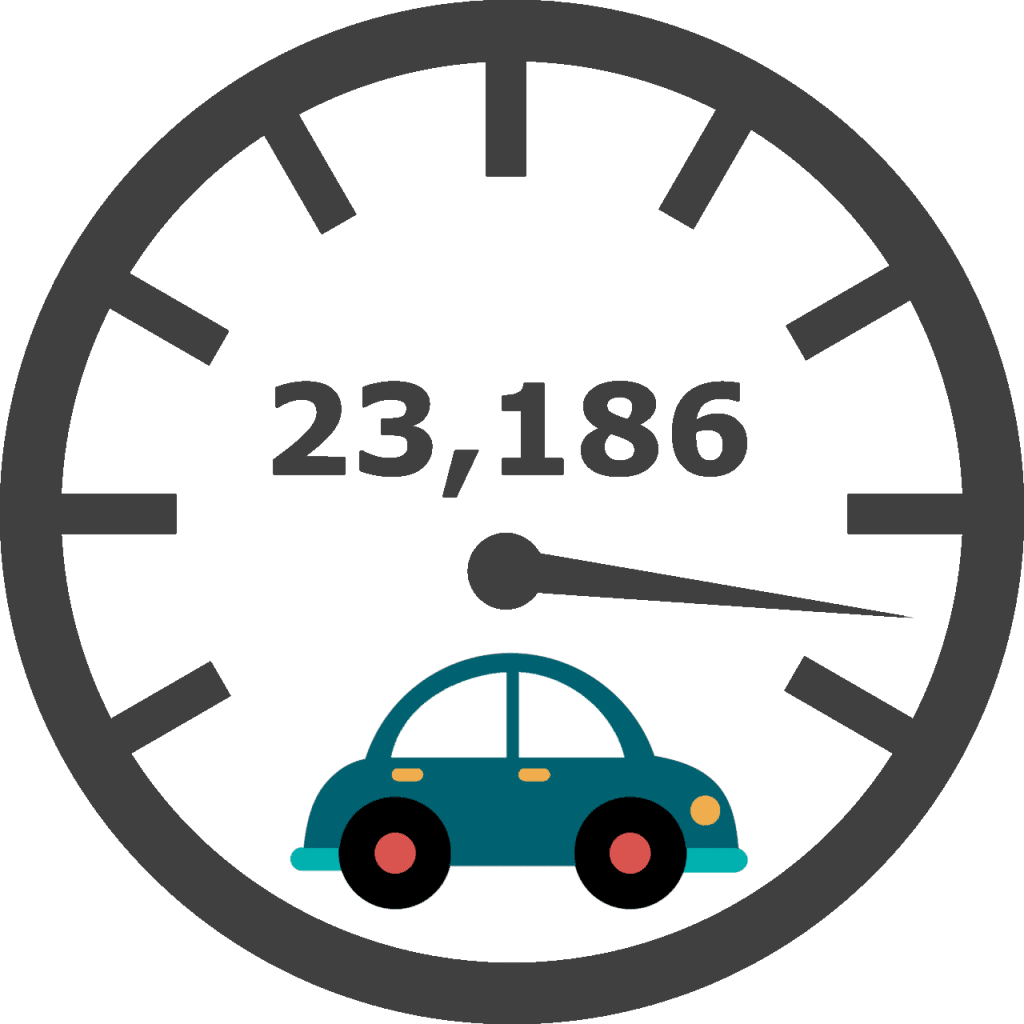

Calculating mileage reimbursement starts by knowing when you actually need to reimburse your employees. Although many employers think that they have to pay for mileage , the federal Government does not require …

We Help Thousands of Employers Manage Time, Time Off, and Expenses