I write a lot about being careful not to short employees their due overtime. First, it’s not fair to employees and, second, wage and hour lawsuits are expensive!

The opposite concern is just as important, however. You don’t want to overpay your employees either.

Not Looking Over the Timesheets

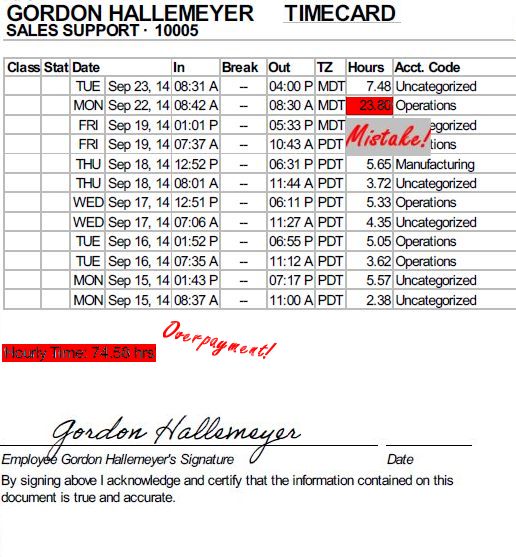

The most common type of mistake that leads to over-payments happens when employees forget to clock out. The next morning when they come in to work, they clock out from an 18 to 24 hour shift. If the admin doesn’t at least scan each timesheet, those incorrect punches might go unnoticed and then get paid. It’s easy to avoid these mistakes because long punches can be spotted with just a glance.

The employee doesn’t clock out for lunches. This could add an extra hour of paid time each day to an employee’s timecard, resulting in about 10 extra hours each biweekly pay period. When checking over the time cards, you should look for 2 entries per day. One will be for the morning half and the other for the afternoon. If employees have a hard time remembering to clock in and out for lunches, set up an automatic lunch deduction.

Denying Employee Generated Timesheet Alerts

Most of the time, alerts represent really legitimate change requests and could bring a time entry down from 18 hours to 8. Be very careful about denying alerts and enable electronic signatures for employees so that you know their eyes reviewed the entries and they agree the timesheet is accurate.

Adding Manual Entries Before the Close of Payroll

Employees might be able to sneak in a time entry between the time when a manager checks over time entries and when he actually closes payroll. To prevent this, review time sheets and then immediately close out payroll. If this is not an option, then you can use the Manual Entry Cutoff option. This prevents employees from entering time before a specified date. You can also mark all records approved when you look at them. If the records change or extras are added, they will not be marked approved and this will be obvious on the pay period report.

One Response